Description

On this Frankly, Nate reflects on his experiences in the financial industry with the cognitive bias Loss Aversion and the ways it may manifest to the coming material throughput declines during The Great Simplification. Why do losses feel so much stronger to us than gains – even when we have an overabundance of wealth? Can being aware of this evolved psychological trait diffuse its intensity? How does this affect our ability to perceive and plan for the reality of less available energy and resources in the future?

In French, we have a motto that says that a simple drawing is often better than a long explanation. Jean-Marc Jancovici Carbone 4 President

That’s very understandable because with left atmosphere thinking, one of the problems is that you see everything as a series of problems that must have solutions. Iain McGilchrist Neuroscientist and Philosopher

We can’t have hundreds and hundreds of real relationships that are healthy because that requires time and effort and full attention and awareness of being in real relationship and conversation with the other human. Nate Hagens Director of ISEOF

This is the crux of the whole problem. Individual parts of nature are more valuable than the biocomplexity of nature. Thomas Crowther Founder Restor

Show Notes & Links to Learn More

00:25 – Loss Aversion

00:56 – Salomon Brothers, Lehman Brothers

04:52 – Psychological responses to the Great Depression

06:23 – Identity and in-groups

06:57 – Supernormal stimuli

07:25 – Green New Deal

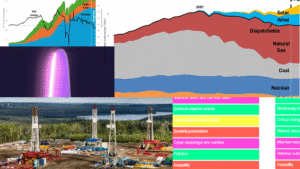

07:43 – Renewables are useful but can’t power current civilization

08:13 – Material limits to happiness

08:51 – Deep Time

09:05 – Biodiversity loss