Show Summary

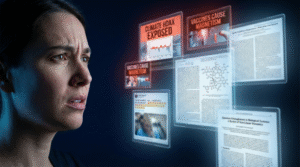

On this episode, Nate is joined by co-founder of GMO Financial Holdings, Jeremy Grantham, to discuss how finance, human population, ecology, and pollution interact to shape current trends and what they could tell us about the future. Mr. Grantham unpacks why the expectations of perpetual growth – in the economy, standards of living, and finance – are not so likely and that when looking at the system holistically we should expect large paradigm shifts in the coming decades. What can the pattern of super (stock market) bubbles over the last century tell us about the larger resource bubble we find ourselves in? How will rapidly changing population demographics and fertility rates interact with the other global crises we face? How might endocrine disrupting chemicals impact these other trends? Where should investors be focusing energy and resources towards to make the largest and most positive impact on human and planetary futures?

About Jeremy Grantham

Jeremy Grantham co-founded GMO in 1977 and is a member of GMO’s Asset Allocation team, serving as the firm’s long-term investment strategist. He is a member of the GMO Board of Directors, a partner of the firm, and has also served on the investment boards of several non-profit organizations. Prior to GMO’s founding, Mr. Grantham was co-founder of Batterymarch Financial Management in 1969 where he recommended commercial indexing in 1971, one of several claims to being first. He began his investment career as an economist with Royal Dutch Shell. Mr. Grantham earned his undergraduate degree from the University of Sheffield (U.K.) and an MBA from Harvard Business School. He is a member of the Academy of Arts and Sciences, holds a CBE from the UK and is a recipient of the Carnegie Medal for Philanthropy.

In French, we have a motto that says that a simple drawing is often better than a long explanation. Jean-Marc Jancovici Carbone 4 President

That’s very understandable because with left atmosphere thinking, one of the problems is that you see everything as a series of problems that must have solutions. Iain McGilchrist Neuroscientist and Philosopher

We can’t have hundreds and hundreds of real relationships that are healthy because that requires time and effort and full attention and awareness of being in real relationship and conversation with the other human. Nate Hagens Director of ISEOF

This is the crux of the whole problem. Individual parts of nature are more valuable than the biocomplexity of nature. Thomas Crowther Founder Restor

Show Notes & Links to Learn More

Download transcript00:32 – Jeremy Grantham work + info

02:45 – Focus on specialists rather than generalists

04:43 – The problem with GDP

04:56 – Kenneth Boulding, Spaceship Earth

07:03 – Cognitive Dissonance

09:54 – Link between debt, money, and energy

11:04 – Jeremy Grantham Super Bubble Interview, What is a Superbubble

12:01 – Paradigm Shifts, Indian Economy Shifts, Oil phase change during OPEC shock

14:38 – Meme stocks

17:31 – Mean Reversion

20:43 – Demographic shifts during the 21st century

20:55 – Time to Wake Up: Days of Abundant Resources and Falling Prices Are Over Forever

21:34 – China’s double digit increase in demand for industrial material consumption

22:20 – Malthus

23:05 – GMO 22 equally weighted commodities index

24:20 – Finiteness of almost everything

24:38 – Abundance of elements in Earth’s crust

26:02 – 1999 was the all-time low extraction costs for oil, have tripled since

27:21 – Classical economics, Keynes

29:44 – Eugene Fama and Kenneth French

32:10 – Carbon Tax

35:42 – The world’s wealthiest emit extensively more carbon and use more energy than the rest

40:20 – Pareto Distribution

41:01 – US Debt

44:10 – Venture Capital

45:05 – Venture Capital average of 15% return

46:29 – Geothermal

47:59 – Fusion

48:59 – Patrick Ophuls + TGS Episode, William Rees + TGS Episode

50:09 – Degrowth

50:35 – Population growth decline

50:53 – South Korea fertility rate of .8

52:49 – Elon Musk on population decline

56:02 – AI risk

1:00:10 – US Mortgage rate

1:00:58 – Capitalism, American Capitalism

1:01:52 – Relatively egalitarian growth in the US prior to 1975

1:01:57 – Fortune 500 CEO’s used to make 40x the average employee, now it’s about 250-400x

1:03:45 – Stock buybacks

1:05:21 – Gini Coefficient, US gini index over time

1:06:49 – Cantillon Effect

1:07:24 – Relationship between the price of assets, interest rates, and inequality

1:08:03 – Minimal economic value to stock buybacks, leverage, hedge funds, and private equity

1:10:01 – Banning and unbanning of stock buybacks

1:13:30 – Scandinavian higher quality of life

1:19:55 – Japan’s COVID response

1:24:20 – Shanna Swan, TGS Episode, research on sperm decline and endocrine disruptors

1:25:25 – E.O. Wilson

1:25:55 – Insect population declining by 2% per year

1:26:43 – Hagai Levine

1:27:10 – DDT

1:28:35 – 1 in 7 couples having trouble with fertility, increased from prior decades

1:29:25 – Pesticides on produce causing endocrine disruption

1:29:50 – Pesticides result in lower sperm counts — Harvard Gazette, Association Between Pesticide Residue Intake From Consumption of Fruits and Vegetables and Pregnancy Outcomes Among Women Undergoing Infertility Treatment With Assisted Reproductive Technology.

1:31:47 – Ducks having similar fertility issues

1:32:06 – Cascade effect

1:32:15 – More than 75 percent decline over 27 years in total flying insect biomass in protected areas

1:38:05 – Fossil fuel companies obfuscating negative effects of fossil fuels

1:51:13 – Female empowerment and fertility rates

1:52:47 – Connection between hormone disruption and interest in procreation

1:53:55 – South Korean trend of not having children and relationships

1:59:23 – Accumulated damage from climate 30-100 trillion

1:59:30 – Stable CO2 at about 350 ppm

2:02:30 – Promising CO2 sequestration methods

2:03:39 – Robot that transforms corn waste into biochar

2:07:01 – American and venture capital

2:08:30 – Circular Economy, France policy making