#121 | Frankly

Wide Boundary News: Japan, Silver, Venezuela, and More – the Biophysical Phase Shift Cometh

Description

This week’s Frankly inaugurates a new category for videos on The Great Simplification platform, Wide Boundary News, in which Nate invites listeners to view the constant churn of headlines through a wider-boundary lens. As we are increasingly inundated with vast quantities of news (and nervous system dysregulation!), it becomes important to be able to tease out a thread on how they interconnect. The stories we tell ourselves about progress, growth, and stability no longer perfectly line up with the biophysical reality beneath them – in Nate’s words, ‘A biophysical phase shift cometh.’

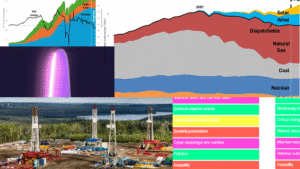

This week’s edition of Wide Boundary News features a look at multiple stories that signal a deep shift in the way humanity’s economic system interacts with planetary resources and ecological systems. Using Japan and silver prices as points of departure, Nate unpacks how the financial layer of our global system has often been mistaken for the whole of reality – obscuring the fundamental inputs of the natural world that keep this system running. He also touches on the global tensions surrounding Venezuela and Greenland by illustrating how the increasing exposure of biophysical limits leads to the perpetuation of geopolitical resource control narratives (and even a resurgence of past visions of ‘Technocracy’). Last but not least, Nate briefly discusses the U.S. polar vortex and a report recently published by the U.K. outlining concerns regarding global biodiversity loss and nature’s say in all this, acknowledging the ways in which the “biophysical blinders” are coming off both institutionally and in our lived experiences.

In what ways do events like Japan’s bond market turbulence and spiking silver prices illustrate the deeper tensions between financial systems and material constraints? How might our institutions, communities, and values change (or double down) as the biosphere’s limits become increasingly hard to ignore? And where, amid bending systems and mounting limitations, do genuine leverage points for a different future still exist?

In French, we have a motto that says that a simple drawing is often better than a long explanation. Jean-Marc Jancovici Carbone 4 President

That’s very understandable because with left atmosphere thinking, one of the problems is that you see everything as a series of problems that must have solutions. Iain McGilchrist Neuroscientist and Philosopher

We can’t have hundreds and hundreds of real relationships that are healthy because that requires time and effort and full attention and awareness of being in real relationship and conversation with the other human. Nate Hagens Director of ISEOF

This is the crux of the whole problem. Individual parts of nature are more valuable than the biocomplexity of nature. Thomas Crowther Founder Restor

Show Notes & Links to Learn More

Download transcriptThe TGS team puts together these brief references and show notes for the learning and convenience of our listeners. However, most of the points made in episodes hold more nuance than one link can address, and we encourage you to dig deeper into any of these topics and come to your own informed conclusions.

00:31 – The Great Simplification

02:48 – Supply chains

04:43 – Frankly #97 The Superorganism in 7 Minutes

05:08 – Externalities

06:24 – U.K. Government Biodiversity Loss and Ecosystem Instability report

07:27 – Overview of Japan

07:32 – Japan’s natural resources

07:46 – Japanese low bond yields

07:48 – Japan’s tech exports

07;50 – Interventions by Japan’s Central Bank

08:14 – Recent Japanese government bond yields

08:33 – Japan’s heavy public debt load

09:30 – Japanese Yen to U.S. Dollar

09:39 – President Trump commenting on risk of weaker dollar

10:19 – Low Japanese interest rates

10:40 – All time highs in price of silver

10:51 – Silver is used in a variety of ways

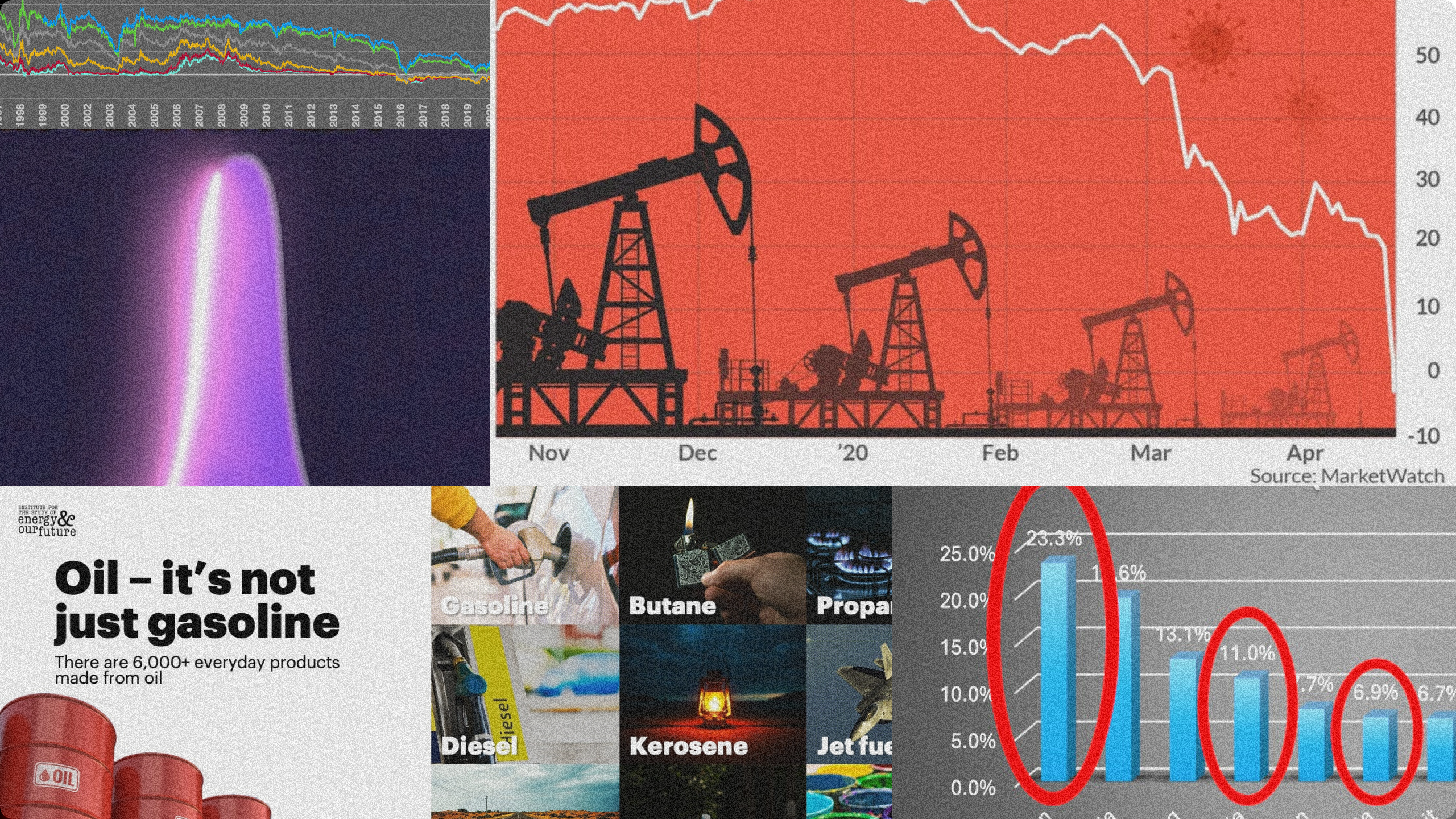

11:26 – 2020 oil futures went negative

11:44 – JPMorgan and silver holdings of over 750 million ounces

11:51 – The Chicago Mercantile Exchange

12:58 – Silver as % of cost of solar panel

13;27 – Net zero

14:11 – Game theory

14:20 – Robert Friedland

14:28 – Copper consumption is 30 million tons per year, % which is recycled

15:09 – Robert Friedland’s video presentation: The Future of Critical Minerals

15:35 – Debt deflation

15:50 – ETF (Exchange Traded Fund)

16:20 – Overview of Venezuela

16:26 – U.S. capture of Maduro

16:41 – Venezuela boasts world’s largest oil reserves

17:02 – Venezuelan oil reserves

17:33 – The products made from crude oil

17:42 – U.S. oil is light, tight oil from shale, pairing with heavy oil when refining

17:55 – Gulf Coast refineries

18:02 – Middle distillates

18:44 – Harold Hamm, announcement no longer drilling shale

19:12 – Wood Mackenzie

19:16 – Oronoco Belt

19:45 – China’s crude oil imports, including from sanctioned countries

19:53 – Shadow fleet

20:13 – China’s massive refinery complexes, 2026 launch of additional petrochemical complex

20:47 – Aircraft carrier USS Abraham Lincoln moving to the Middle East

21:17 – Overview of Greenland

21:25 – Davos 2026

21:44 – The Great Depression

21:47 – Technocracy movement

22:22 – Howard Scott

22:47 – Map proposing the Technate of America

23:49 – John Maynard Keynes

25:00 – Frankly #44 The Many Shapes of the Carbon Pulse, oil production growth

25:25 – Silicon Valley, and its power

27:01 – MI5 and MI6

27:13 – Positive feedback loops

27:49 – Melting Himalayan glaciers

28:06 – The Freedom of Information Act

28:14 – Eco-terrorism

28:16 – NATO (North Atlantic Treaty Organization)

28:20 – The “bread basket” of Ukraine and Russia

28:51 – I.C.E. (U.S. Immigration and Customs Enforcement), situation in Minneapolis

29:09 – Polar vortex

29:14 – Recent extreme cold in the Midwest, deep freeze in the continental U.S.

29:29 – Arctic warming (NOAA Arctic Report Card; Update for 2025)