Ep 207 | Craig Tindale

Why the West Can’t Defend Itself: How Material Scarcity Is Reshaping Global Power

Description

For decades, the West has outsourced its own material production to other countries, in favor of lower costs and short-term returns over more expensive, long-duration investments like mining and manufacturing. But while this has seemed like a success on the surface, it has left us with a society based on consumption, unable to produce what we need on our own. What are the deeper costs of this long-term offshoring – including for our geopolitical, climate, and technological ambitions?

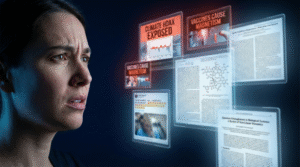

In this conversation, Nate is joined by materials expert and investor Craig Tindale, who explores the profound vulnerabilities facing Western economies by what he calls “Industrialization 2.0.” Craig argues that decades of central banking policies favoring consumption and short-term returns have led the West to offshore virtually all materials production and processing to China – limiting the West’s ability to defend itself, as well as rebuild industrial capacity to address the growing technological needs of climate and AI. Tindale also introduces his “four clocks” framework, which describes how corporate quarterly cycles, 10-20 year climate urgency, immediate defense needs, and continuous consumption addiction are all ticking at different speeds and pulling society in incompatible directions. Furthermore, he posits that Silicon Valley’s “unspoken bet” is on human obsolescence, with capital flowing to robot owners rather than human workers.

How do all of these pieces – monetary policy, critical materials, climate action, geopolitical risk, and technological displacement – fit together to create a perfect storm for humanity’s future? Why might the only path to a circular economy be “through the valley of death” – forced by necessity rather than choice? And what types of practical investments and technological innovations are needed to make our societies more resilient in the face of impending geopolitical and economic turbulence?

About Craig Tindale

Craig Tindale is a private investor who has spent nearly four decades working in software development, business strategy, and infrastructure planning, including in leadership positions at Telstra, Oracle, and IBM. Additionally, he has direct experience working in east-to-west supply chains, including as the CEO and Asia Regional Director for DataDirect Technologies.

He’s now pivoted to investing in groundbreaking ideas such as drone reforestation through Air Seed Technologies, and uses his knowledge of Chinese industrial strategy and Western tech demand to identify the choke points in Critical Metals markets. Most recently he released the white paper, Critical Materials: A Strategic Analysis, which offers a systems synthesis on how the race for rare earths and the return of material constraints is shaping geopolitical relationships.

In French, we have a motto that says that a simple drawing is often better than a long explanation. Jean-Marc Jancovici Carbone 4 President

That’s very understandable because with left atmosphere thinking, one of the problems is that you see everything as a series of problems that must have solutions. Iain McGilchrist Neuroscientist and Philosopher

We can’t have hundreds and hundreds of real relationships that are healthy because that requires time and effort and full attention and awareness of being in real relationship and conversation with the other human. Nate Hagens Director of ISEOF

This is the crux of the whole problem. Individual parts of nature are more valuable than the biocomplexity of nature. Thomas Crowther Founder Restor

Show Notes & Links to Learn More

Download transcriptThe TGS team puts together these brief references and show notes for the learning and convenience of our listeners. However, most of the points made in episodes hold more nuance than one link can address, and we encourage you to dig deeper into any of these topics and come to your own informed conclusions.

00:00 – Craig Tindale (His Substack)

- His Whitepaper: The Return of Matter: Western Democracies’ Material Impairment

- Substack Essay: THE HARD BIFURCATION: The Convergence of Financial Liquidity and Physical Insolvency

- Substack Essay: Cost of Capital, Industrial Irreversibility, and the Survival of Western Mining and Smelting: A Geopolitical Analysis of Strategic Divergence

04:09 – Value chain, Global North outsources energy resources

05:10 – Economic rationalism

05:55 – Weighted Average Cost of Capital for long-term industrial investment: U.S. vs. China, (More info)

06:20 – Holocene epoch

07:09 – Asset price inflation, Wealth effect

09:21 – Net Present Value (NPV)

09:39 – U.S. investment in software, State of U.S. manufacturing industry

11:19 – Short-rate model, December 2025 Federal Reserve interest rate cuts

12:12 – Tariffs, Effect on the production economy

12:14 – History of U.S. debt ceiling

12:34 – Ben Bernanke, Bernanke’s contributions to economics, Neoclassical economics shift towards prioritizing consumption economy, 2008 financial crisis

12:54 – Neoclassical economics, Craig’s critique of neoclassical economics

13:37 – Significant U.S. governmental responses to financial crises

14:20 – U.S. government investment to expand domestic production of critical minerals/materials

15:20 – Metallgesellschaft AG, Role in Australian zinc mining/production

16:00 – Germany’s early global domination in metal industry

16:10 – Critical metals needed for military operations, Shell Crisis of 1915/Battle of Aubers Ridge, David Lloyd George

17:05 – 60% of the world’s copper is refined in China, Copper refinement process, Chinese export regulations

18:07 – 72% of silver comes from other metal refining, Slag

18:50 – China limiting of silver exports, 58% of silver consumption is industrial, Silver in solar panels and AI industry

19:40 – Price of silver commodity

19:50 – Russia outpacing NATO countries in weapons production

20:11 – Critical mineral: Antimony – Critical to U.S. economy and national security

20:40 – Human G-force tolerance

22:25 – Renison Tin Operation – Chinese off-take agreement

23:20 – China has financed *184 mines outside of China

24:39 – Lynas Rare Earth’s outpriced by China in attempt to open mining operations

25:00 – BHP and Rio Tinto, FMG all have deals to send iron ore to China for smelting

26:00 – Chinese energy mix, China has double the U.S. energy capacity even with smaller economy

26:43 – Copper requirements for data centers, *63 data center mega-projects currently planned in the U.S.

27:45 – AI used for mining optimization/efficiency, Rise in automated mining vehicles, Autonomous vehicles’ operational uptime improving

29:39 – American government recent investment in critical mineral mines/supply chains

31:20 – U.S. DoD has effectively 15% stake in MP Materials

31:45 – Average American energetically consumes 210,000 kcal/day *as of 1986

33:18 – U.S. total financial assets

33:57 – James Tour, Flash-Joule heating, Fly ash pollution, E-waste recycled into gold

35:27 – Zhigang Zach Fang metallurgist, F-35 titanium usage, Titanium exports by country

37:45 – AI Index Report

39:10 – Most of machinery is from China,China export shipping timelines, CEO of Lynas: we could build a rare earth refinery in Texas but at what cost?

39:45 – The 5 Horsemen of the 2020s + Emergent Horsemen, Nate explaining the original 4 Horsemen of the 2020s

41:35 – The West: Throw-away society

42:41 – *Global circularity rate is 6.9%, Recycling rate by country

42:50 –Lithium-ion battery recycling

44:10 – Silver in 1 large missile vs. 1 solar panel

46:31 – Replacing and recycling solar panels

47:38 – West is leading in AI software (and why that’s a chokepoint), Nuance of Chinese dependency on U.S.

48:19 – World’s top AI superpowers in 2025

49:10 – Trump recently decided to allow China to import NVIDIA’s H200 chips

50:40 – Critique of IPCC Climate Models, IPCC report “uncertainty bars”

52:25 – Stratospheric aerosol injection: Albedo change, Increase rainfall, Health effects

53:00 – Future of human climate niche, ND-GAIN Country Index, List of areas depopulated by climate change

53:25 – IMO 2020 – reduce sulfur oxide emissions

54:10 – Trees sweat to keep cool

54:50 – Shortage of clouds in China and Gulf Coast of North America, Cloud clumping creating dangerous rains

56:25 – Slowing of the AMOC, TGS Episodes on the AMOC: Levke Ceasar (Ep #124) & Leon Simons (Ep #105)

56:40 – Ocean warming

57:45 – Off-shore windfarms cited as national security threat

58:40 – Germany current energy challenges

59:05 – Energy and Water use of AI in the U.S.

59:30 – AI data centers in Sydney ~*12% of its electricity and ~*25% of its water by 2035

1:00:01 – AI Productivity, AI Automation

1:01:40 – Democratic socialism

1:05:35 – Neo-Luddism, Fertility rates decreasing, Aging population

1:06:25 – Airseed Technologies

1:06:50 – How animals grow forests, Decline in bird populations

1:07:40 – Human-induced tree loss over time, Land-use change effect on carbon emissions

1:10:15 – Anastassia Makarieva (TGS #193), Biotic Pump, Mixed-species vs. monocultures in plantation forestry

1:11:00 – Rain forest evapotranspires ~20,000 gallons per acre vs. Pasture evapotranspires ~1050 gallons per acre

1:13:25 – Timeline of home gardening in the U.S.

1:15:30 – Degrowth vs Post-growth

1:16:10 – Great Reforming Time 1990s-2000s: Privatization, Deregulation, Floating exchange rates

1:16:50 – Fiat currencies, Gold reserve, U.S. held *70% of gold reserves after WWII

1:24:20 – Australia: Net positive migration, Less housing per person than *most other Western countries, Housing vacancy issues, Housing price crisis

1:35:40 – Forest bathing, Benefits of Nature experiences